Bookkeeping

now browsing by category

Temporary Account Definition, Examples, and How to Close

Content

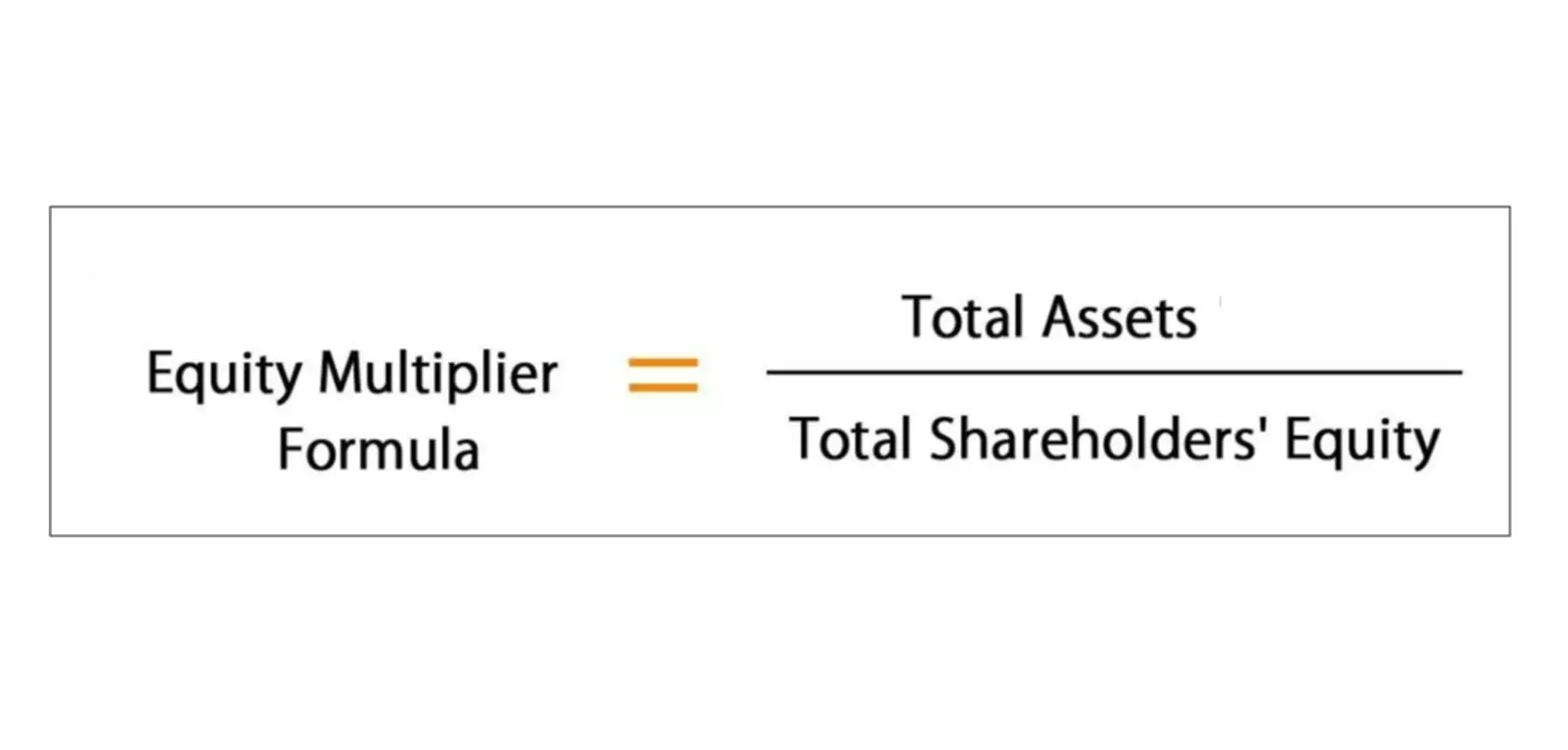

Leased and rented aircraft do not include those used under interchange agreements designed to provide oneplane service over the routes of the air carriers involved. An entity (air carrier) which, as the result of a business combination, has acquired the net assets, and carries on the operations of, one or more predecessor air carriers, and which may be newly organized at the time of the combination or may be one of the predecessor air carriers. Month-end financial statements (balance sheet and income statement) simply summarize and group the balances that are in the individual accounts at month end. Accordingly, financial statements can be no more detailed or informative than the underlying chart of accounts structure. On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190. We need to do the closing entries to make them match and zero out the temporary accounts.

- “Aircraft Type” refers to aircraft models (such as B–707–100, B–707–300, DC–9–30, etc.) that are prescribed in the Accounting and Reporting Directives, which is available from the Office of Airline Information.

- (a) Revenues and expenses attributable to a single natural objective account or functional classification shall be assigned accordingly.

- Record here the cost of oils used in flight operations.

- The brake horsepower developed at specified altitudes, atmospheric temperatures, and flight speeds and under the maximum conditions of rotor shaft rotational speed and gas temperature, and approved for use during periods of unrestricted duration.

- Record here the compensation, including vacation and sick leave pay, of air carrier personnel engaged in law research or representing the air carrier in matters of law.

- In cases where the responsibility for maintaining purchasing and stores records are inseparable, the related compensation may be accounted for in accordance with dominant responsibilities.

The discussion flows and inevitably someone says “It would be nice if we could see…” The CFO gets an exasperated expression on their face and writes the request on their notepad. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. Carbon Collective does not make any representations or warranties https://www.bookstime.com/ as to the accuracy, timeless, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Carbon Collective’s web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

3 Passenger Handling Personnel.

(h) All other ground equipment of all types and classes such as medical, photographic, employees’ training equipment, and airport and airway lighting equipment. (g) Materials and supplies held in small supply and purchased currently may be charged to appropriate expense accounts when purchased. (b) Each air carrier shall subdivide this account in such manner that the balance can be readily segregated as between balances in United States currency and the balances in each foreign currency.

This account shall be subdivided to reflect the nature of each intangible asset included in this account. (c) Equipment of all types and classes used in enplaning and handling traffic and in handling aircraft while on ramps, including motorized vehicles used in ramp service. Classes of equipment used interchangeably between handling aircraft on ramps and in maintaining aircraft may be classified in accordance with normal predominant use.

Impersonal Accounts

Reporting Carrier List means a list maintained and published by the Office of Airline Information (OAI). Carriers report O&D data consistent with these regulations, but a carrier is not required to report until OAI adds the carrier to the Reporting Carriers List. Carriers must also determine the responsible reporting carrier for Category Two tickets using the first reporting carrier rule and should use the Reporting Carriers List to determine the responsible reporting carrier.

Scrap Metal Reseller Pleads Guilty to Filing a False Corporate Tax … – Department of Justice

Scrap Metal Reseller Pleads Guilty to Filing a False Corporate Tax ….

Posted: Fri, 19 May 2023 07:00:00 GMT [source]

When assignment of expense items on the basis of the primary activity to which related does not in the aggregate result in a fair presentation of the expenses applicable to each function, apportionment shall be made between functions based upon a study of the contribution to each function during a representative period. For the purposes of this part, a standard weight of 200 pounds per passenger (including all baggage) is used for all civil operations and classes of service. Other weights may be prescribed in specific instances upon the initiative of the Department of Transportation or upon a factually supported request by an air carrier. The carriage, pursuant to 49 U.S.C. 41103, by aircraft of property and/or mail as a common carrier for compensation or hire in commerce between a place in any State of the United States, or the District of Columbia, or Puerto Rico, or the U.S.

4 Liquor and food—depreciation expense.

(g) Property and equipment of all types and classes used in storing and distributing fuel, oil and water, such as fueling trucks, tanks, pipelines, etc. (i) Subaccounts shall be established within this account for the separate recording of each class or type of spare parts and supplies. (c) This account should be charged or credited for discount or premium on United States Government securities or other securities which should be amortized to profit and loss account 80 Interest Income. (a) Record here the cost of short-term https://www.bookstime.com/articles/temporary-accounts investments such as special deposits and United States Government securities, any other temporary cash investments, and the allowance for unrealized gain or loss on current marketable equity securities. (3) A statement to the effect that a sales listing of the value of all unmatched auditor coupons has been compiled and compared to the general ledger control figure; the statement required by this subparagraph shall indicate whether or not the value of the unmatched coupons is in agreement with the general ledger.

The difference between the book cost and the residual value of property and equipment. A facility where air transportation is sold, and related processes of documentation and reservation confirmation are performed. Transport service operated pursuant to published flight schedules, including extra sections and related nonrevenue flights. Transport service established for the carriage of passengers which may also be used jointly for the transportation of cargo. Transport service established for the carriage of passengers moving at either standard fares or premium fares, or at reduced fares not predicated upon the operation of specifically allocated aircraft space, and for whom standard or premium quality services are provided. The date on which property or equipment is permanently withdrawn from services of the corporate entity.

2 Unamortized Aircraft Engine Overhauls.

The total current assets figure is of prime importance to company management regarding the daily operations of a business. As payments toward bills and loans become due, management must have the necessary cash. The dollar value represented by the total current assets figure reflects the company’s cash and liquidity position. It allows management to reallocate and liquidate assets—if necessary—to continue business operations.

Which of the following categories of accounts are temporary accounts that are closed?

Temporary accounts include revenue, expenses, and dividends, and these accounts must be closed at the end of the accounting year.

This figure shall reflect the payload or total available capacity for passengers, mail and freight applicable to the aircraft with which each flight stage is performed. Computed by multiplying the interairport distance of each flight stage by the number of passengers transported on that flight stage. (c) Reports required by this section shall be submitted to the Bureau of Transportation Statistics in a format specified in accounting and reporting directives issued by the Bureau of Transportation Statistics’ Director of Airline Information. (a) Record here credits to operating expenses, which have not been cleared to the objective accounts to which applicable.

0 Interest Income.

The authority for these instructions is found in 14 CFR part 241, sec. 19–7. (29) 820 Aircraft days assigned to service—carrier’s routes. (a) Each air carrier required to file Form 41 Schedule T–100 data shall maintain its operating statistics, covering the movement of traffic in accordance with the uniform classifications prescribed. Codes are prescribed for each operating element and service class.

What are the 5 types of accounts that can be created?

- Assets.

- Expenses.

- Liabilities.

- Equity.

- Revenue (or income)

Best Bookkeeping Classes Kansas City, MO: Find Courses & Onsite Training

Content

The accounting and bookkeeping work that you need can be customized to each client’s needs and requirements. For the small business, this may just mean quarterly bookkeeping for quarterly tax projections. The larger small business may need information almost daily so that they can operate their business with the margins of their industry.

Whether you’re an individual who needs their taxes prepared or a small business owner who needs tax, bookkeeping, QuickBooks or payroll services, we are the right firm for you. Kansas City Business Solutions is a financial consulting firm that provides streamlined business services for owners of small enterprises throughout the Kansas City area. Its team handles a full suite of services including complete bookkeeping, sales and expense tracking, profit and loss statement and balance sheet compilation, payroll processing, bill payment, inventory management, and invoicing. Kansas City Business Solutions is a certified QuickBooks ProAdvisor. As a small firm with more than 30 years of experience, we provide personalized service that is very efficient for our clientele.

Service Providers

Some companies may only offer a flat monthly fee for end to end accounting services in Kansas City that is all inclusive. Other companies offer a monthly payment plan with additional tasks like bank reconciliations and custom reporting offered on an la carte basis. For most small businesses, basic bookkeeping service in Kansas City costs $110 per month up to $1000 per month for more complex situations or high volumes of transactions. Shawn Williams is a certified public accountant that brings more than 10 years of tax & accounting experience to Kansas City. Located in the Zona Rosa shopping district in the Northland, we are here to help you with all of your tax and accounting needs.

Bookkeeping Solutions Plus is a bookkeeping expert that offers affordable financial services to businesses and individuals in the Kansas City area. The firm specializes in online and remote small business bookkeeping services which involve QuickBooks setup and cleanup, accounts payable review, accounts receivable review, bank account reconciliation, and data entry. When you need help with invoicing, collections and accounts receivable, just getting pricing for accounting services in Kansas City can be daunting with so many options.

Reller & Company, CPA, P.C.

If you are on our Starter plan, we will complete your business income taxes. For sole proprietors and single-member LLCs, we will also complete your personal income taxes. For other business entities on our Starter plan, we can help file your personal income taxes for a $300 fee. At Mazuma, we are confident we can provide your Missouri small business with comprehensive tax and bookkeeping services at the most affordable price. Sophisticated entrepreneurs know that a one-size-fits-all approach to bookkeeping doesn’t cut it. Your financials need to be customized to your business to give you meaningful information, delivered timely, and done with impeccable accuracy.

- This business also assists with tax codes and the payment process of submitting tax compensation to government bodies.

- You’ll quickly find that there’s no need to have “a bookkeeper near me” when you can call or send an email to your dedicated lead accountant and receive a same-day response.

- We also provide tax advice throughout the year to help you maximize your return and minimize your taxes.

- The firm specializes in online and remote small business bookkeeping services which involve QuickBooks setup and cleanup, accounts payable review, accounts receivable review, bank account reconciliation, and data entry.

- VBOCs can also help you navigate SBA’s extensive resource partner network and refer you to a community partner, lender, or SBA program.

- Don’t worry about having existing books to show us – we’ll help you get your books, financial statements, and records put together, whether you haven’t opened your doors yet or you’ve been in business for years.

- No matter your plan, all federal and state year-end business income taxes are included.

Services involve monitoring incoming and outgoing payments, ensuring that the end-of-month A/P and A/R balance, and processing monthly financial information to prepare reports for stakeholders. This business also assists with tax codes and the payment process of submitting tax compensation to government bodies. VBOCs assist clients in developing and maintaining a five-year business plan. The business plan includes such elements as the legal form of the business, equipment requirements and cost, organizational structure, a strategic plan, market analysis, and a financial plan. Financial plans include financial projections, budget projections, and funding requirements.

Here to help you thrive, at tax time and beyond.

Streamline your finances with bookkeeping, taxes, and accounting that fit your business and budget. Mazuma specializes in Missouri business taxes and accounting so you can rest assured your finances are in good hands. Bench — A top of the line company that is highly tech savvy with their own app so you can access your info on the go. Bench offers a variety of services that are great for small businesses just starting out. Our fully equipped team of tax professionals have over 100 years of collective experience in tax services. Our tax professionals have over 100 years of combined experience to provide you with the best customized approach to tax management so that we can reduce tax bills and boost business efficiency.

To find the perfect fit for you, it’s important to determine what your training goals are. With Bookkeeping encompassing so many verticals and subtopics, it could be challenging to find what you’re looking for. We’ll help you break down the subcategories and related topics (see the Bookkeeping topics section) to focus directly on one of the subcategories.

You may need in-house accounting staff supplemented by a Dark Horse Fractional CFO. Either way, we’ll let you know what we believe to be the best approach for your business. However, in certain situations where transactions are very limited (such as during the initial year of a start-up), we can conduct quarterly or annual bookkeeping services.

You can always schedule a time to meet one on one with our bookkeepers or accountants through our Mazuma Dash. In addition, we hold Q&A webinars three times bookkeeping kansas city per week where clients can ask our accountants their questions live. With Mazuma, you can be confident you are getting all the deductions you deserve.

Why Choose Remote Books Online?

We have compiled all the information you need to make an informed decision when it comes to outsourcing bookkeeping for small business in Kansas City to ensure best practices are met. Our services include account management for small businesses and enterprises, allowing us to focus on the specific business challenges facing your operation. Whether you need help with accounting, business capital advice, interest rate reviews, and more, we provide the best-in-class service you’d expect from leading accounting firms in Kansas City. TaxesPlus provides a holistic approach to your accounting, payroll, and different tax needs. We can help you manage the different compliance components that it takes to operate and run business by having a variety of services all under one roof.

- Our Block Advisors small business services are available at participating Block Advisors and H&R Block offices nationwide.

- Whether you live in Kansas City or St. Louis, we’ll provide you with financial insights to help build your business success all while you save stress, time, and money.

- Here are a few typical services you can expect a dedicated accounting service in Kansas City to offer, although these are not all inclusive.

- Our fully equipped team of tax professionals have over 100 years of collective experience in tax services.

- Services involve monitoring incoming and outgoing payments, ensuring that the end-of-month A/P and A/R balance, and processing monthly financial information to prepare reports for stakeholders.

- Combine the convenience of in office visits with a local accounting service in Kansas City and online chat and video video support necessary.

No matter your plan, all federal and state year-end business income taxes are included. When you outsource with bookkeeping services in Kansas City to a partner that specializes in small to medium sized clients, you can rest assured that the job is being taken care of and allows you to focus on your business. We provide bookkeeping services on a monthly, quarterly, or annual basis.

Together, we work seamlessly to provide exceptional service in support of our clients’ success. Our membership and active participation in Kreston International, an international network of independent accounting firms, extends our reach to more than 125 countries. Looking for reliable online accounting and bookkeeping services in Kansas City? We’re a comprehensive accounting firm offering a wide range of services for both small businesses and individuals here in Kansas City. Our goal is to provide accessible, efficient, and affordable financial services for everyone. As a small business owner, it is important to prioritize not only your business needs, but also your time.

- Cost for monthly accounting services starts at $500/month and can include tax advisory services for owners, members, and shareholders.Please contact us for more information and to schedule a consultation.

- Whether you’re an individual who needs their taxes prepared or a small business owner who needs tax, bookkeeping, QuickBooks or payroll services, we are the right firm for you.

- Either way, we’ll let you know what we believe to be the best approach for your business.

- Exigo Business Solutions is a technology solutions provider that has been serving business owners throughout the Liberty area since 2009.

- Our team is made up of experienced accounting professionals well equipped with the knowledge you need to succeed, so you’ll always feel like you have a partner there to support you.

Generally Accepted Accounting Principles GAAP

Content

Revenues and expenses recognized by a company but not yet recorded in their accounts are known as accruals (ACCR). By definition, accruals occur before an exchange of money resolves the transaction. Even if you opt to use accounting software or hire a professional, use the tips we’ve reviewed in this guide to understand accounting basics. Similar to other processes and strategies across your business, you’ll want to constantly review and evaluate your accounting methods. All financial reporting methods should be consistent across time periods.

- Even if this results in minor transactions being recorded, the idea is that it’s better to give a comprehensive look at the business — this is especially important in the event of an audit.

- According to this principle, only transactions that you can prove should be recorded.

- You may follow generally accepted accounting principles or a different standard.

- All businesses have to come up with ways of capturing and reporting accounting data.

- As a result, the FASB works with the Private Company Council to update GAAP with private company exceptions and alternatives.

This sometimes allows companies to defer the recognition of certain expenses into future accounting periods. The basic accounting principles listed here overlap with a handful of GAAP concepts, https://www.bookstime.com/articles/direct-vs-indirect-cash-flow like matching and materiality, but do not cover all of them. For a full rundown of GAAP and what each concept means, see NerdWallet’s generally accepted accounting principles (GAAP) explainer.

GAAP Principles

This gives each person a full and clear picture of your business before they make an agreement. It’s also a good idea to set your fiscal year when you start your business. Financial data should be presented based on factual information, not speculation. It’s also a commitment to presenting data in the fairest and most accurate way possible. There are four main types of expenses, although some expenses fall into more than one category. The cost of goods sold (COGS) or cost of sales (COS) is the cost of producing your product or delivering your service.

- Assets are then remain on the balance sheet at their historical without being adjusted for fluctuations in market value.

- As a result of this principle, a company’s financial statements will include many disclosures and schedules in the notes to the financial statements.

- Certified public accountants and management accountants are two of the profession’s most common specializations.

- This is done to avoid confusion in financial records and make it easier to distinguish between business activities during an audit.

- The latter sense of the term adjusts these investments for any gains or losses the owner(s) have already realized.Accountants recognize various subcategories of capital.

- New GAAP hierarchy proposals may better accommodate these government entities.

- I wrote a short description for each as well as an explanation on how they relate to financial accounting.

Capital refers to the money you have to invest or spend on growing your business. Commonly referred to as “working capital,” capital refers to funds that can be accessed (like cash in the bank) and don’t include assets or liabilities. A cash flow statement analyzes your business’s operating, financing, and investing activities to show what are basic accounting principles how and where you’re receiving and spending money. A balance sheet is a snapshot of your business’s financial standing at a single point in time. A balance sheet will also show you your business’s retained earnings, which is the amount of profit that you’ve reinvested in your business (rather than being distributed to shareholders).

Basic Accounting Principles What You Need to Know

The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices. Wrapping up, there’s no denying that accounting plays a crucial role in running a business. All businesses have to come up with ways of capturing and reporting accounting data. To provide useful information and simplify decision-making, businesses will have to use consistent accounting methods, procedures and standards. If you adhere to these established principles, not only do you get reliable and sustainable workflow but also confidence in future growth. The principle states the importance of recording expenses and liabilities once they occur BUT only recording assets and revenue when there’s a certainty of these occurring.

The general ledger (GL or G/L) is the master account containing all ledger accounts. Each transaction recorded in a general ledger or one of its sub-accounts is known as a journal entry. The terms and concepts in this guide were curated in part for their relevance to new entrepreneurs. Examples include terms such as “accounts payable,” “accounts receivable,” “cash flow,” “revenue,” and “equity.” This principle states that the accountant has reported all information consistently throughout the reporting process. Under the principle of consistency, accountants must clearly state any changes in financial data on financial statements.

Join 41,000+ Fellow Sales Professionals

Most financial institutions will require annual GAAP-compliant financial statements as a part of their debt covenants when issuing business loans. Accounting is the process of tracking and recording financial activity. People and businesses use the principles of accounting to assess their financial health and performance. Accounting also serves as a useful way for people and companies to honor their tax obligations.

- The cost of goods sold (COGS) or cost of sales (COS) is the cost of producing your product or delivering your service.

- Tracking operations that record, administrate, and analyze the compensation paid to employees are collectively known as payroll accounting.

- Synder automates the recording process so you’ll be able to improve and implement appropriate business strategies.

- Even though they appear transparent, non-GAAP figures can create confusion for investors and regulators.

- Whether you provide freelance services, set up shop at a local farmer’s market, or run a global e-commerce business, you need an easy (and legal) way to collect what you’ve earned.

At no point can a company or financial team choose to ignore or modify any of the regulations. The monetary unit principle states that businesses should only record transactions that can accurately be stated in terms of currencies or units of value. The matching principle is a simplistic concept that states you should record all expenses related to revenue at the same time that you record the original revenue.

Principle of Utmost Good Faith

Accountants are expected to fully disclose and explain the reasons behind any changed or updated standards in the footnotes to the financial statements. The ultimate goal of GAAP is to ensure a company’s financial statements are complete, consistent, and comparable. This makes it easier for investors to analyze and extract useful information from the company’s financial statements, including trend data over a period of time. GAAP helps govern the world of accounting according to general rules and guidelines. It attempts to standardize and regulate the definitions, assumptions, and methods used in accounting across all industries.

It’s excellent that you’ve got the previous month’s statistics, but that won’t be enough. What you need now is to compare your company’s profits or your accounting clients over an extended amount of time. Revenue – (also known as sales) the financial information reflecting the customers’ value for the product. That’s actually what you’re going to gain by selling services or something else.

Accounting is something that most people have heard about at work, on TV, or online. The 35-member Financial Accounting Standards Advisory Council (FASAC) monitors the FASB. FASB is responsible for the Accounting Standards Codification (ASC), a centralized resource where accountants can find all current GAAP. The FAF is responsible for appointing board members and ensuring that these boards operate fairly and transparently. Members of the public can attend FAF organization meetings in person or through live webcasts.

Why Accounting For Real Estate Agents is So Important

Content

Keep records of how much you pay your workers, and document all of your operational expenses so you know how much money you need to earn each week to break even or earn a profit. Each day, at the end of business, you’ll “zero out” the cash register or POS system and create the reports of the day’s sales. With that information, you’ll create a single entry into QuickBooks for each server which will record his or her total sales for the day.

Not only will you need to conduct comprehensive market analysis, but you will also need to manage financing, consultants, and a builder. It isn’t one of the things that should be nagging your mind when you look to the future and plan your next business decision. Giving our clients the financial support they need to succeed in their business is our only business. Business is difficult enough but no longer has to be with Remote Books Online on your side. Speak with an agent to get a quote and setup an appointment with a Certified QuickBooks Pro Advisor to go over your books. In order to use this type of software, you must have comprehensive knowledge about accounting principles, so you can understand how it works and what it does for you.

Basic Bookkeeping for Real Estate

These decisions may involve purchasing new equipment, paying bonus checks to employees and owners, or simply preparing for the estimated payment due. At Casey Moss Tax, you’ll receive tax liability estimates and planning https://www.vizaca.com/bookkeeping-for-startups-financial-planning-to-push-your-business/ tips throughout each tax year, helping you stay ahead of the game. Hall CPA PLLC, real estate CPAs and advisors, helped me save $37,818 on taxes by recommending and assisting with a cost segregation study.

- Let’s face it – most new business owners are not financial professionals.

- The IRS and general accounting principles require the cost of the new roof to be spread out over that time.

- With a set accountancy services in place, you van be rest assured that you are able to create gainful business arrangements.

- All successful freelancers and businesses have stable finances and tight books.

While this may make sense in the beginning, maintaining this practice becomes increasingly burdensome as units are added. This allows for easier tracking of capital expenditures (more on that later). The most common report is a profit-loss statement, which shows all the property’s income streams, expenses, and cash flow. If you are bookkeeping in a spreadsheet, you essentially create the profit-loss statement each month while entering the income and expenses. Lastly, after entering in all this data for the property, you now will be able to generate reports on the success of your property.

The Basics of Investing in Rental Properties in a Recession

Avoid the expenses and complexities of hiring and training in-house staff, and enjoy the flexibility and scalability of our services, tailored to your unique requirements. We utilize advanced accounting software and automation tools to streamline processes, delivering faster and more accurate results. Take the hassle out of real estate bookkeeping with REA’s comprehensive outsourced services. Our specialized team of experienced accountants will provide accurate, timely, and scalable bookkeeping solutions that can save you over 30% compared to hiring in-house. With user-friendly accounting solutions made available to businesses of all shapes and sizes, there is really no excuse not to get started today. The right real estate accounting system always considers everything that makes your small business unique.

Canadian, US, and international clients benefit from a breadth of specialized CPA accounting and taxation services. A real estate bookkeeping service can provide a number of benefits to the homebuyer and the agent. A real estate bookkeeping service can help you with your accounting tasks and make your life easier. It will take some time (and adjustments along the way) to get your accounting books set up initially. But when it’s done properly, your real estate business will be better for it in the long run. We don’t recommend creating revenue or expense categories specific to units or properties (for example, a “rents collected” account for each property).

Continuing Education Costs

Besides that, real estate agents have specific accounting and tax considerations that should be handled by an expert with industry experience. We provide tax preparation services to real estate investors and businesses of all types. Having a clean set of books allows for real time internal financial analysis and up-to-date information for your advisors.

This is a massive benefit in terms of time and convenience, but you should continually monitor and perform monthly checks on your accounts. Handling the accounting for your real estate practice doesn’t have to be a major hassle. A strong foundation in accounting best practices paves a smooth path for your business to flourish and win new clients. Prepare your tax-related documents, keep them updated, and stay prepared for the tax season with our tax preparation services. The digital age has revolutionized every aspect of daily life, including how people go about conducting real estate business.

How does virtual bookkeeping for real estate work?

This is a simpler type of package, and you can do this if you have an accountant or not. You don’t have to, the Xero platform has everything you need, but if you’re already on Quickbooks, no problem. There is a handy import tool that can handle any kind of standard input.

Another reason is for tax purposes and to quickly assemble the required documents for an audit if one’s business is selected. In this short article, we explored the key aspects of real estate accounting. We looked at the fundamentals of real estate accounting and then moved to discussing the differences between accounting and bookkeeping.

Learn how much a Real Estate Bookkeeper costs!

Especially with complicated real estate transactions, it is best to capture as much information about the deal as possible then let your computer do the sorting. 90 percent of entrepreneurs fail, and – as you are probably aware – poor accounting is a primary reason. Don’t allow yourself to fly blind, switch to paperless accounting today. It is almost impossible to be a successful investor if you don’t know where your money is going or coming from. You don’t need to be a financial wizard, but you should have a basic understanding of debits, credits, and all expenses. If you glance at your books once a month, you very well could be throwing away money.

What is a Schedule K-1 Tax Form?

For example, companies must issue to their partners K-1s that provide details on their share of yearly earnings, their share of dividends and interest earned from the investment and other information. If you’re involved in a partnership or are considering entering one, you may want to consult a legal advisor to make sure you have a full understanding of the partnership agreement and how it informs documents such as Schedule K-1. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances.

Don’t use this amount to complete your Form 1116, Foreign Tax Credit; or Form 1118, Foreign Tax Credit—Corporations. Use the amounts the partnership provides you to figure the amounts to report on Form 3468, Part II. Interest and additional tax on compensation deferred k1 meaning under a section 409A nonqualified deferred compensation plan that doesn’t meet the requirements of section 409A. See section 409A(a)(1)(B) to figure the interest and additional tax on this income. Report this interest and tax on Schedule 2 (Form 1040), line 17h.

Worksheet for Adjusting the Basis of a Partner’s Interest in the Partnership (continued)

If these expenses are deducted in full in the current year, they’re treated as an adjustment or tax preference item for the Alternative Minimum Tax. Generally, section 59(e)(2) lets the partner amortize the expense for a number of years to avoid the Alternative Minimum Tax adjustment. If you’re unsure where the box 13, code H amount should be entered, use the descriptions above along with the partners’ instructions for Schedule K-1. Box 13 is used to report many different items, so select on the codes below to view the instructions on entering them.

If the corporation had more than one trade or business activity, it will attach a statement identifying the income or loss from each activity. The partnership will report on an attached statement your share of qualified food inventory contributions. The food inventory contribution isn’t included in the amount reported in box 13 using code C. The partnership will also report your share of the partnership’s net income from the business activities that made the food inventory contribution(s). The amount reported in box 1 is your share of the ordinary income (loss) from trade or business activities of the partnership.

Factoring in Partnership Agreements

Generally, if the aggregate cost of the production exceeds $15 million, you aren’t entitled to the deduction. The limitation is $20 million for productions in certain areas (see section 181 for details). If you didn’t materially participate in the activity, use Form 8582 to determine the amount that can be reported on Schedule E (Form 1040), line 28, column (g). If you materially participated in the production activity, report the deduction on Schedule E (Form 1040), line 28, column (i).

This penalty is in addition to any tax that results from making your amount or treatment of the item consistent with that shown on the corporation’s return. According to the IRS, “Schedule K-1 must be provided to each partner on or before the day on which the partnership return is required to be filed.” Timing is also dependent on the entity’s fiscal year. If you’re expecting a K-1 and haven’t received one on time, you might choose to file for a tax extension (though that only delays filing, not having to pay if you owe taxes). If you file your taxes and receive a K-1 afterward, you will have to amend your tax return. Schedule K-1 requires pass-through businesses to track each partner’s basis, or stake, in the company. Basis can be increased or decreased each year depending on each partner’s profits, losses, additional contributions or withdrawals.

What Is IRS Schedule K-1?

When it comes to partnerships, it is crucial to establish a clear identity for the entity. The name of the partnership is not only a formality but also a way to differentiate it from other businesses in the market. In order for the entity to send you the K-1, it first needs to complete its own tax return.

- Partners and shareholders of S corporations must file a Schedule K-1 to report income, losses, dividend receipts, and capital gains.

- Ever-changing regulations mean the form is subject to frequent changes.

- If you have any foreign source qualified dividends, see the Partner’s Instructions for Schedule K-3 for additional information.

- For more information on the special provisions that apply to investment interest expense, see Form 4952 and Pub.

Let’s say you are a business partner earning $50,000 in taxable income in a given year. If you and your sole proprietorship own 50% of the business each, you should each receive a K-1 showing an income of $25,000. For one partner who owns 60% and another who owns 40%, the former will receive a K-1 for $30,000 and the latter for $20,000.

How to Scale a Business: 7 Steps Beyond 7 Figures

In my experience, a strong and growing business can get loans much easier than new businesses, and it can find investors much easier as well. Also, with a solid organizational design plan, it is a lot easier to find financial support. It’s quite clear that scalability demands an expanded skill set. Entrepreneurs need to build a team with a diverse skill set. It is important that your team understands your business goals and strive to achieve them on time without compromising on quality.

The bank’s corporate leaders also tried to change attitudes by publicly celebrating both managers who shared their region’s innovations and those who adopted those created by others. The bank’s leaders also highlighted such innovations and the teams involved in these efforts in company newsletters. What’s the point of scaling a business if it doesn’t produce loyal customers? Creating raving fans of your product is critical to allowing your business to thrive amid the ebb and flow of ever-changing consumer preferences.

Signs you’re ready for the next stage of growth

“It’s the exact same grade of material, it’s just taken at a different point in the supply chain.”The fabric rolls allow for faster production but with the same commitment to sustainability. It’s even become a feature—getting their hands on a particular color lets them create a limited time collection drop that customers snap up. Nail down where your business is right now, as well as where you want your business to go.

Global Smart Scale Market (2023 to 2030) – Key Players Include … – GlobeNewswire

Global Smart Scale Market (2023 to – Key Players Include ….

Posted: Fri, 23 Jun 2023 09:42:33 GMT [source]

All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. The applications vary slightly from program to program, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. Do you want to master a proven framework for building and financing new ventures? Explore our four-week online course Entrepreneurship Essentials, and discover how you can learn the language of the startup world.

Scaling a Small Business FAQ

For example, you could be interviewed on a podcast whose audience overlaps with your own. Up until this point, we’ve talked a lot about scaling in regards to making the right connections with your customers. However, in order to sustain those new connections, your team needs to have the right processes in place.

- Business scaling also means ensuring that your internal processes and operations are functioning seamlessly.

- At the consumer goods company, for example, one innovation priority was packaging, which led to specific innovations in materials and size and format.

- Knowing your purpose and successfully communicating that to your team is the way to make them raving fans of your company and organically drive growth.

- I say not only do you have to know the end you’re aiming for, but you also need to know why you’re going there.

- For instance, during the initial stages of a business, you have a few members in your core team who multitask.

When you start preparing early on and you lay the right foundation, taking the appropriate steps to scale won’t seem quite as overwhelming. Only offer things you can do really well and that are in high demand. Once you start to get your footing again, you can start to reintroduce new products or services that supplement your core offerings. Offering too many products or services can make customer relationships difficult to manage, and you’ll have a hard time controlling the quality of so many different items.

Scaling a Business

You don’t have to settle for 30% growth when you can scale your business to 30 times its size. When a business grows, it can mean its operations process costing definition and meaning expand, its sales increase, it adds more locations, or all of the above. As one part of the business grows, another part grows at the same rate.

Then, the key results will be to collect feedback from 100 top buyers, interview 200 former customers, and acquire a satisfaction rate of at least 4.5 out of 5. Take a hard look inside your business to see if you are ready for growth. You can’t know what to do differently unless you take stock of where your business stands today. Start with the basics—figure out what you need to do to scale before your growth gets out of your control. There’s a lot of work to be done—something one person can’t take on completely by themselves.

Misaligned Incentives and Culture

Instead, find a reliable partner to outsource, thus positioning your business to scale better, faster, and cheaper. Create a strategic plan that includes a monthly sales outlook and milestones. Define your target audience, marketing strategies to reach them, and conversion strategies. Current expenses will be used as a baseline to estimate the cost of expansion.

Accenture and Google Cloud Help Organizations Scale Advances in … – Newsroom Accenture

Accenture and Google Cloud Help Organizations Scale Advances in ….

Posted: Wed, 21 Jun 2023 17:43:02 GMT [source]

Both of these KPIs will help you determine whether you are on the road to reaching your goals. Break down every sector of your business into not only positions but also the responsibilities of each position. When you have specific and clear responsibilities in place, you will be able to actually measure success, both of current employees and of job candidates. Consider how every role is connected and who will support who. Don’t think about how your organization chart looks NOW; think about how it should look in the FUTURE. This future organization chart should be a picture of what the business will look like at that 5-year goal.

Double‐Entry Bookkeeping

Content

While your ledger gives you an idea of how much money is in your account, it does nothing to help you track your expenses, or know how much money your customers owe you. This is how you would record your coffee expense in single-entry accounting. When you log into your bank account online, or receive your bank statement in the mail, you’ll see a list of all of your activity for the month. That activity includes things like the $5.50 you spent at the coffee shop during your breakfast meeting as well as the customer payment you deposited. Marilyn asks Joe if he can see that the balance sheet is just that—in balance. Joe looks at the total of $20,000 on the asset side, and looks at the $20,000 on the right side, and says yes, of course, he can see that it is indeed in balance.

- In general terms, it is a business interaction between economic entities, such as customers and businesses or vendors and businesses.

- Formally, the summarized list of all ledger accounts belonging to a company is called the “chart of accounts”.

- Instead, each transaction affects just one account and results in only one entry (as opposed to two).

- In the double-entry accounting system, transactions are recorded in terms of debits and credits.

If you’re not sure whether your accounting system is double-entry, a good rule of thumb is to look for a balance sheet. If you can produce a balance sheet from your accounting software without having to input anything other than the date for the report, you are using a double-entry accounting system. Most modern accounting software, like QuickBooks Online, Xero and FreshBooks, is based on the double-entry accounting system. The double-entry system began to propagate for practice in Italian merchant cities during the 14th century. Before this there may have been systems of accounting records on multiple books which, however, do not yet have the formal and methodical rigor necessary to control the business economy.

Double-Entry Bookkeeping

The double entry accounting system is a method for companies of all sizes to accurately record the impact of transactions and keep close track of the movement of cash. A double entry accounting system requires a thorough understanding of debits and credits. The third financial statement that Joe needs to understand is the Statement of Cash Flows.

Joe can tailor his chart of accounts so that it best sorts and reports the transactions of his business. Double-entry bookkeeping produces reports that allow investors, banks, and potential buyers to get an accurate and full picture of the financial health of your business. The accounting system might sound like double 20 Best Accounting Software for Nonprofits in 2023 the work, but it paints a more complete picture of how money is moving through your business. And nowadays, accounting software manages a large portion of the process behind the scenes. If the bakery’s purchase was made with cash, a credit would be made to cash and a debit to asset, still resulting in a balance.

Who invented double-entry accounting?

While you can generate an income statement from this type of system, you will be severely limited in your ability to track liabilities and assets. Using this system reduces errors and makes it easier to produce accurate financial statements. Unlike single-entry accounting, which requires only that you post a transaction into a ledger, double-entry tracks both sides (debit and credit) of each transaction you enter. The chart below summarizes the differences between single entry and double entry accounting. In short, a “debit” describes an entry on the left side of the accounting ledger, whereas a “credit” is an entry recorded on the right side of the ledger. Because the accounts are set up to check each transaction to be sure it balances out, errors will be flagged to accountants quickly, before the error produces subsequent errors in a domino effect.

According to the same rules of double entry, if you have your own bank account, your deposit will be an asset in your books and thus a debit in your bank account. Any payment from this asset account will thus be a credit entry to show that the asset has decreased in value. Always remember that the bank’s https://adprun.net/what-to-expect-from-accounting-or-bookkeeping/ records are a mirror image of your own as your deposit is a liability to them but an asset to you. Double-entry accounting is a bookkeeping system that requires two entries — one debit and one credit — for every transaction. Your books are balanced when debits and credits zero each other out.

What is Double Entry Accounting?

Simultaneously, the company’s notes payable account (a liability) increases by $50,000, so it is credited for this amount. Both sides of the accounting equation increase by $50,000, and total debits and credits remain equal. Double entry accounting is a record keeping system under which every transaction is recorded in at least two accounts. There is no limit on the number of accounts that may be used in a transaction, but the minimum is two accounts.

The Ultimate Guide to the Three Financial Statements

Content

Typical sources of cash flow include cash raised by selling stocks and bonds or borrowing from banks. Likewise, paying back a bank loan would show up as a use of cash flow. If a business plans to issue financial statements to outside users (such as investors or lenders), the financial statements should be formatted in accordance with one of the major accounting frameworks. These frameworks allow for some leeway in how financial statements can be structured, so statements issued by different firms even in the same industry are likely to have somewhat different appearances. Financial statements that are being issued to outside parties may be audited to verify their accuracy and fairness of presentation. Any items within the financial statements that are valuated by estimation are part of the notes if a substantial difference exists between the amount of the estimate previously reported and the actual result.

What are the basic financial statements?

The four basic financial statements are the income statement, balance sheet, statement of cash flows, and statement of retained earnings. Your financial statements are dynamic reports full of insights just waiting to be extracted and used to achieve your business objectives.

For example, some investors might want stock repurchases while other investors might prefer to see that money invested in long-term assets. A company’s debt level might be fine for one investor while another might have concerns about the level of debt for the company. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (Member SIPC), offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal Housing Lender), provides deposit and lending services and products.

Accounting Directive – 2013/34/EU

In the United States, especially in the post-Enron era there has been substantial concern about the accuracy of financial statements. Corporate officers—the chief executive officer (CEO) and chief financial officer (CFO)—are personally responsible for fair financial reporting that provides an accurate sense of the organization to those reading the report. Generally Accepted Accounting Principles (GAAP) are the set of rules by which United States companies must prepare their financial statements. It is the guidelines that explain how to record transactions, when to recognize revenue, and when expenses must be recognized. International companies may use a similar but different set of rules called International Financial Reporting Standards (IFRS). The operating activities on the CFS include any sources and uses of cash from running the business and selling its products or services.

Here you will find all of salesforce.com’s SEC filings including the prospectus, proxies, quarterly, and annual filings. Our Standards are developed by our two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB). The next line is money the company doesn’t expect to collect on certain sales. This could be due, for example, to sales discounts or merchandise returns. IAS 1 was reissued in September 2007 and applies to annual periods beginning on or after 1 January 2009.

Audited financial statements 2020 (A74/

https://marketresearchtelecast.com/financial-planning-for-startups-how-accounting-services-can-help-new-ventures/292538/ have to include – as a minimum – the balance sheet, the profit and loss account and a certain number of notes to the financial statements. Large and medium-sized companies also have to publish management reports. A balance sheet shows a snapshot of a company’s assets, liabilities and shareholders’ equity at the end of the reporting period. It does not show the flows into and out of the accounts during the period.

Notes to financial statements are considered an integral part of the financial statements. Unlike the balance sheet, the income statement covers a range of time, which is a year for annual financial statements and a quarter for quarterly financial statements. The income statement provides an overview of revenues, expenses, net income, and earnings per share. The three main reports within the financial statements are the balance sheet, income statement, and cash flow statement. As with an income statement, the statement of cash flows reflects a company’s financial activity over a period of time. It shows where a company’s cash comes from and how it’s used to pay for operations and/or to invest in the future.

TOP 10 BEST BOOKKEEPING SERVICES in Kansas City, MO June 2023 Yelp

Content

- For High Net Worth Individuals in Kansas City, Missouri

- Best Bookkeeping Services in Kansas City

- Reller & Company, CPA, P.C.

- Let us help get your company financials better organized and easier to manage!

- Free price estimates from local Tax Professionals

- Simple. Affordable. Professional.

- Looking For a Trusted Accountant in Kansas City?

I appreciate that he is willing to take the time to explain things I may not have a grasp on. Our team was founded on the belief that nobody should have to battle the IRS alone. We have a team of over 100 Tax Preparers, Tax Accountants, CPAs, case managers, and other staff working behind the scenes. – giving you the freedom of knowing that your books are in the hands of the right professional, every time. We utilize the tools within QBO and Xero to provide a dashboard of financial information about your company so that everything interacts seamlessly. As a member of The Professionals Alliance Group, we collaborate with Oppenheimer & Co. to help you develop comprehensive strategies suitable to your financial objectives.

We work closely with businesses to help them make smarter and more informed business decisions. Great bunch of people, I believe Lisa Sawtelle has a huge role in that and making things run efficiently. I have no problem recommending the firm and always give her name with the recommendation.

For High Net Worth Individuals in Kansas City, Missouri

Kansas City Business Solutions is a financial consulting firm that provides streamlined business services for owners of small enterprises throughout the Kansas City area. Its team handles a full suite of services including complete bookkeeping, sales and expense tracking, profit and loss statement and balance https://www.bookstime.com/ sheet compilation, payroll processing, bill payment, inventory management, and invoicing. Kansas City Business Solutions is a certified QuickBooks ProAdvisor. Bookkeeping Solutions Plus is a bookkeeping expert that offers affordable financial services to businesses and individuals in the Kansas City area.

Whether you need help with accounting, business capital advice, interest rate reviews, and more, we provide the best-in-class service you’d expect from leading accounting firms in Kansas City. Melissa assists in preparation of individual income tax returns, prepares accounting records and payroll returns for our business clients, and maintains the social media outlets and website information. We understand that the accounting work is the backbone of your tax return. Detail and concern is a requirement when working with financial information so that you can file an accurate and timely tax return. Our team setup ensures that you continue to work with the same accountant no matter where you are. Additionally, we ensure that your is information is protected with our strict security protocols for both internal and external policies.

Best Bookkeeping Services in Kansas City

Collaborating with your accounting experts maximizes your company’s potential to enhance its bottom line. They also offer services in Gladstone, Parkville, Liberty, Smithville, Platte City, North Kansas City, Leavenworth, Lansing, Northland, Downtown, and Zona Rosa. Reach out to them today for a complimentary initial consultation. Is a full-service accounting firm that offers individualized financial services to small businesses and independent professionals in the Kansas City area. Is equipped with more than 17 years of experience in the industry.

We provide strategic consulting across all areas of accounting, bookkeeping, and financial management. Polston Tax works with you as your partner to ensure you get the help that you need to grow your business. Our tax professionals have over 100 years of combined experience to provide you with the best customized approach to tax management so that we can reduce tax bills and boost business efficiency. Our team includes specialists who perform a full range of services for our community banking clients. We offer you best practice business ideas to help you run your bank.

Reller & Company, CPA, P.C.

He has prepared our taxes for the past 2 years, including some circumstances that were out of the ordinary. Shawn is always helpful with the many questions we have going through the tax preparation process, and he works hard to find the most beneficial filing situation. He is also very affordable compared with H&R Block who we used for many years before we found Shawn. Accounting packages are customized and scoped for the needs of each client before an engagement is finalized. Cost for monthly accounting services starts at $500/month and can include tax advisory services for owners, members, and shareholders.Please contact us for more information and to schedule a consultation.

How much should I charge as a bookkeeper?

To help answer some of your burning questions, take a look at a few average rates: The average hourly wage for a bookkeeper in the U.S. is $22 per hour. CPAs typically charge $200 – $250 per hour. Top bookkeepers in major cities may charge $500 per hour (or more).

Exigo Business Solutions also provides free initial consultations. Williams Tax & Accounting, LLC stands out as a leading accounting firm dedicated to providing you with precise and essential data for achieving success. Their comprehensive range of tax and accounting services is designed to assist you effectively. With over ten years of expertise in tax Bookkeeping Services in Kansas City and accounting, Shawn Williams, a certified public accountant, leads the team. The Williams Tax & Accounting, LLC team excels in serving and submitting federal and state returns promptly and efficiently for various entities. In addition, their tax planning and consulting services are tailored to align your financial goals with optimal tax efficiency.

Let us help get your company financials better organized and easier to manage!

Our fully equipped team of tax professionals have over 100 years of collective experience in tax services. We ensure thorough and accurate records across bookkeeping, payroll, financial transactions, and provide customized long-term consulting for your business. Our expertise includes residential and commercial real estate investors, commercial developers and property management companies. Our industry-specific strategies help you maximize your portfolio’s return on investment.

- Exigo Business Solutions also provides free initial consultations.

- The use of cloud-based programs and collaboration tools allow for full financial and data transparency with real-time updates, without the compromise of security.

- Services involve monitoring incoming and outgoing payments, ensuring that the end-of-month A/P and A/R balance, and processing monthly financial information to prepare reports for stakeholders.

- FORVIS can leverage experience with a wide variety of organizations, including membership, religious, and professional organizations to help you stay on track and reach your goals.

- We can interpret, summarize and present complex financial and business-related issues in a manner that is both understandable and properly supported.

- Our professionals understand the unique complexities for high net worth individuals and will help you with a variety of consulting and planning services.

- We have a team of over 100 Tax Preparers, Tax Accountants, CPAs, case managers, and other staff working behind the scenes.

We emphasize the importance of tax planning while effectively identifying and communicating tax savings strategies. Qualified professionals with over 100 years of collective industry experience, knowledge, and insight into tax law. The use of cloud-based programs and collaboration tools allow for full financial and data transparency with real-time updates, without the compromise of security. We can interpret, summarize and present complex financial and business-related issues in a manner that is both understandable and properly supported.

Free price estimates from local Tax Professionals

It’s time to get proactive about your accounting and bookkeeping. From QuickBooks to Xero, cash flow to credit card processing, invoices to bill pay we are here to help you gain control of your small business operations. When it comes to our Outsourced CFO services, our on-staff CFOs aren’t just well-versed when it comes to handling every aspect of a business’ financial picture, they’ve actually held the title. Our team will review your bank’s interest rate risk management process.

What is a full charge bookkeeper?

What is a Full Charge Bookkeeper? A full-charge bookkeeper is the same as a bookkeeper, except that the "full charge" part of the title designates the person as being solely responsible for accounting.

Definition of Business Process Automation BPA IT Glossary

The article will break down everything you need to know about business process automation and how you can apply it to streamline your operations. Intelligent BPM solutions work on deep process transformation and innovation. Business processes aren’t just about getting things done, they embody competitive advantages and determine profitability. That’s why the race is on to innovate and accelerate business processes toward digital transformation. BPM is not new as a discipline, but today BPM technologies and solutions are evolving both how it’s done and how it interacts with other digital transformation tools and objectives. Today’s platforms can automatically produce reports that compare your accounts to the same quarter of the following year.

As evidenced by these examples, business process automation can deliver quantitative results in terms of time and cost. But it also delivers a range of other benefits, including retaining top talent by preventing burnout and improving employee experience. But to scale your business, some of those repetitive and manual tasks need to be automated to improve efficiency and reduce the errors that come with business expansion. Any business or organization that follows a process can benefit from business process automation.

Automating the process using a BPM tool

I’ll admit that business process automation isn’t the first thing that comes to mind when I see the acronym “BPA.” Given the benefits below, maybe it should be. With the help of BPA, you can use automation to streamline your processes using machine learning to enhance both employee and customer experience. Here are a couple of business process automation examples to get a better idea of how you can use automation. Along with these capabilities, automated data entry can help lower operational costs on tasks that would otherwise be done manually. While BPA and robotic process automation (RPA) are similar, there are some differences between the two terms.

The downside is that your workflows can quickly turn into a disorganized, hodgepodge mess of integrations that are difficult to understand and maintain. This is particularly true if the person responsible leaves and you don’t have a stellar handover process in place. This is primarily of interest to organizations with complex legacy systems that aren’t currently capable of interfacing with other systems through APIs.

Best Practices for Implementing Process Automation

Furthermore, the process engine will be in charge of comprehending the business rules and making choices based on them. For example, in a Purchase Request process, you can set that if the quotation is larger than $10,000, it will be sent to management for a second approval. Process automation can free labor-intensive personnel to concentrate on more worthwhile duties by eliminating tedious and repetitive jobs.

Integrate the tools you use every day to create seamless workflows across your organization. In a market saturated with SaaS applications for digital Business process automation transformation, a productivity plateau has been reached. This highlights Hyper-Productivity™ as the crucial next step in your digital journey.

Business process automation tools and software

Project management software like Asana, Basecamp, ClickUp, Trello and others all have automation available that may accomplish your objectives. Schedule a demo with your existing project management software to explore features and functionalities that may be underutilized or unlocked on different tiered plans. By Brett Farmiloe, serial entrepreneur, founder of Markitors and Terkel, a knowledge platform that converts expert insights into articles for small businesses. Horizontal processes that are not core to the business, but where best-practice execution is valuable, such as payroll processing or IT.

How AI can improve your business process automation – SiliconRepublic.com

How AI can improve your business process automation.

Posted: Fri, 18 Aug 2023 09:46:02 GMT [source]

This is why it’s vital that companies standardize their operations and document them. As much as possible, employees should have one reference that explains how to execute each task for which they are responsible. Sending an invoice for the wrong amount could mean your company either doesn’t invoice for as much as they earned or appears to be overcharging a customer. Neither incident ends well, especially if it’s a mistake that can occur more than once. This is a good example of how, even if you’re able to resolve the problem without anyone losing money, the “cost” may hurt your company’s reputation, which is incredibly valuable.

Hyper-Productivity™: The Next Frontier to Your Digital Transformation Journey

Much of this increase in performance can be attributed to four key benefits of business process automation that every business enjoys. In fact, it was one of the major buzzwords of this decade, along with artificial intelligence, and Bitcoin. However, automation has been part of a paradigm shift, digitally transforming business. Part of this broader automation industry is BPA, a new approach to optimizing business operations, improving core competencies, and reducing costs.

All this, of course, affects the company bottom line – higher productivity, leading to higher profits. Change requires innovation, and even fast moving companies can fall behind on getting innovative ideas to market, software can help solve the problem. Flokzu offers a Sandbox to test such versions in a safe environment before being put into use, and functionality for managing processes in versions. Starting an improvement cycle is possible after you have the KPIs and the data necessary to pinpoint the faults and the chances for change. 1) Assignments issued to a human or another system with a deadline, responsibilities, and decisions to make in this task. All POs and purchase requests automatically route to the right approver for fast approvals from anywhere.

A Blueprint for Digital Transformation Through Business Process Automation Published By Info-Tech Research Group – Yahoo Finance

A Blueprint for Digital Transformation Through Business Process Automation Published By Info-Tech Research Group.

Posted: Tue, 15 Aug 2023 20:15:00 GMT [source]

Streamline internal operations and optimize front-office and back-office processes with low-code. It pays to stay on top of your expenses, literally, but it’s no fun filling out expense reports manually. Hiring can be a long, arduous process, and with more employees jumping ship more often than in the past, the hiring processing is increasing in frequency. Many of the employees you’ll be hiring are categorized as Millennials, and beyond all the hype (both positive and negative), this group of employees has taught us a valuable lesson for the on-boarding process.

For a better understanding of business process automation(, here are a couple of use cases. It’s common for organizations to apply BPA as part of a digital transformation strategy, in order to streamline their workflows and operate more efficiently. Low-code development platforms are another type of BPA automation tool.

- If the customer ticket contains a keyword about the new bug or issue, you can send out an automated reply to each new ticket apologizing and explaining what the problem is.

- During the on-boarding process, a younger employee doesn’t want to wait around for somebody to show her what to do—she wants to be given the tools to do it herself.

- Simple to use, easy to comprehend, and possesses adaptability and scalability.

- Software robots and automation solutions in business process management (BPM) are just the next steps in the digital transformation of traditional business processes that we already perform daily.

- By Brett Farmiloe, serial entrepreneur, founder of Markitors and Terkel, a knowledge platform that converts expert insights into articles for small businesses.

Here you can centralize the information to easily find each business opportunity status and the last proposal submitted. In addition, you can quickly get reports and statistics to improve each instance with customers. A classic example of a process that benefits from BPA is onboarding new employees. This process traditionally involved a lot of paperwork, phone calls, and follow-up questions via email. With BPA, an organization can automate many of an employee’s first interactions with a company—for example, processing badges, setting up payroll, and handling video training. That saves time and hassle for both the new employee and the HR team, and gets employee engagement off to a good start.

But RPA is just a piece of a successful business automation strategy, not a replacement for or competitor to it. Because the moment you need a human to weigh in with a cognitive decision, RPA on its own no longer suffices. If your essential procedures could use efficiency boosts, you can do one better than hiring a broke college kid to fumble through the menial tasks.

Business process management is the practice of designing, executing, monitoring, and optimizing elements of a business, or business function. BPM takes a very broad view and looks at the behavior of people, information, and systems. One of the common misconceptions of BPA is that it takes weeks, or even months, to implement. We hope that if you’ve made it this far, you can see that there are plenty of processes ripe for automation that have implementation timelines of a single day.

Using machine learning, artificial intelligence, and automation technology can translate into a wide range of benefits for small business owners, organizations, and Fortune 100 companies alike. Benefits depend on the what, where, when, why, and how an automated process. However, you’ll notice the advantages of BPM and automation tools throughout an organization. While you can use business process automation to optimize business processes, business process management (BPM) can involve tactics outside of automation to streamline and enhance procedures. In short, BPM may or may not include BPA, but BPA always contributes to improving BPM. If you’re still manually working on payroll, you’re missing out on the benefits of automating the process.